Bitcoin extends advance following Federal Reserve meeting

The crypto coin is up over 50 per cent since Trump's election victory, leading some to ask if the rally is due a breather

Article content

Bitcoin extended its biggest jump in more than a week following the United States Federal Reserve’s latest monetary policy meeting and comments from Chair Jerome Powell that touched briefly upon crypto regulation.

The largest digital asset rose 1.3 per cent to about US$105,134 as of 8:30 a.m. on Thursday in New York, adding to a climb of 3.5 per cent yesterday. Smaller tokens such as Ether and Solana also pushed higher.

Fed officials on Wednesday paused monetary easing, and Powell in his customary briefing signalled that the central bank will need to see more progress on inflation before considering any further reduction in interest rates.

In response to a question about risks from digital assets, Powell said banks are “perfectly able to serve crypto customers as long as they understand and can manage the risks” and added that “a greater regulatory apparatus around crypto” from Congress would be “very constructive.”

The comments were staid and measured but come against a backdrop of heightened investor expectations for friendly digital-asset regulations under President Donald Trump, who has tightly embraced the crypto sector.

‘Maturing’ Rally

“Traders in the U.S. were reacting to the crypto comments from Powell, and Bitcoin pushed higher,” said IG Australia Pty Market Analyst Tony Sycamore. “From a wider technical perspective, there are indications that the Bitcoin rally is maturing.”

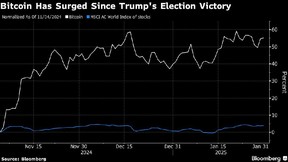

Bitcoin hit a record US$109,241 ahead of Trump’s inauguration on Jan. 20 but subsequently slipped back. The token is up over 50 per cent since his election victory in early November, leading some to ask if the rally is due a breather.

Others argue widening U.S. engagement with crypto portends further gains. Some of the latest developments include CME Group Inc.’s move to roll out futures products on Robinhood Markets Inc.’s app, including for Bitcoin and Ether.

Investment firms are also peppering the Securities & Exchange Commission (SEC) with proposals to start more crypto exchange-traded funds (ETFs). The companies are “probing the SEC’s boundaries, with unique filings including memecoin ETFs,” Bloomberg Intelligence Senior Government Analyst Nathan Dean wrote in a note.

Bitcoin’s moves lately have been correlated with U.S. technology shares. As a result, the token may have benefited from a rise in Nasdaq 100 equity futures on Thursday as investors digested corporate earnings reports.

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.